Forex Technical Analysis 2011/30/08 (EUR/USD, GBP/USD, USD/CHF, SILVER) Forecast FX

29.08.2011

Forecast for August 30th, 2011

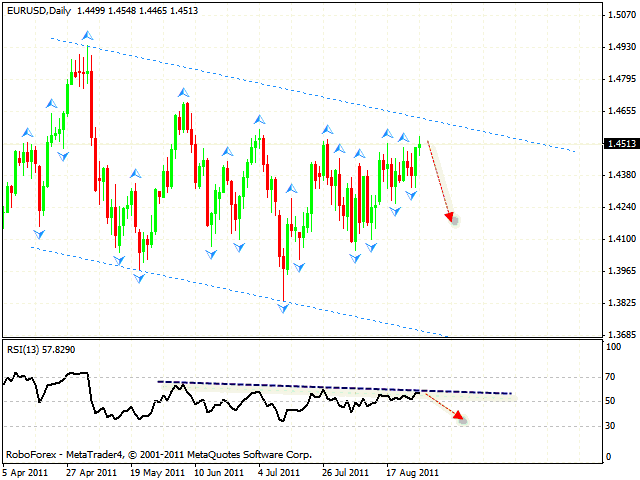

EUR/USD

The EUR/USD currency pair keeps moving upwards inside a narrow range. However, at the daily chart of the pair the RSI indicator faced the resistance from the trend’s descending line. We should expect the indicator to rebound from it and start moving downwards. The target of the fall is the area of 1.4200.

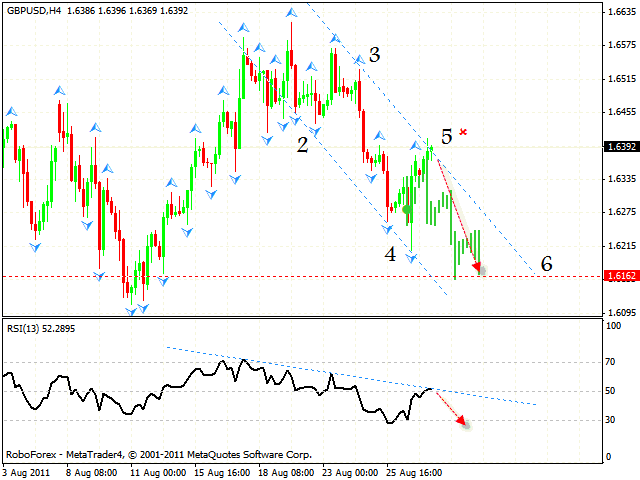

GBP/USD

The GBP/USD currency pair keeps moving downwards inside the pattern with the target in the area of 1.6160. Currently the price is testing the channel’s upper border, one can try to sell the pair with the tight stop. The price testing the trend’s descending line at the RSI is an additional signal to sell the pair.

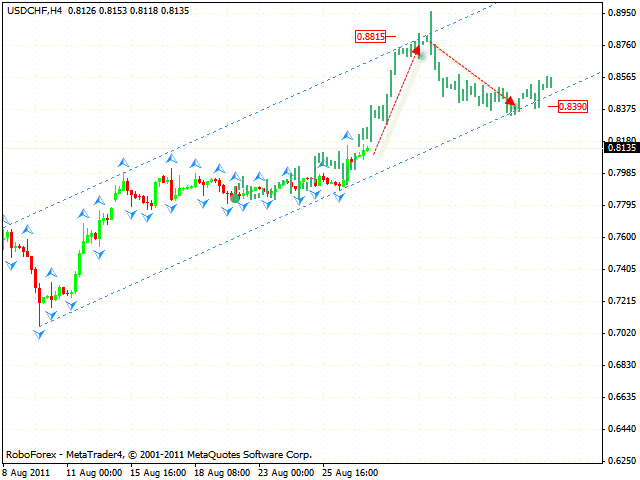

USD/CHF

If the trend is in favor of Dollar, we should expect the price to grow with the closest target in the area of 0.8815. This area may be a starting point of the correction to the channel’s lower border. One can try to buy the pair in the area of 0.8390. However, if the price breaks the channels and leaves it, this case scenario will be cancelled.

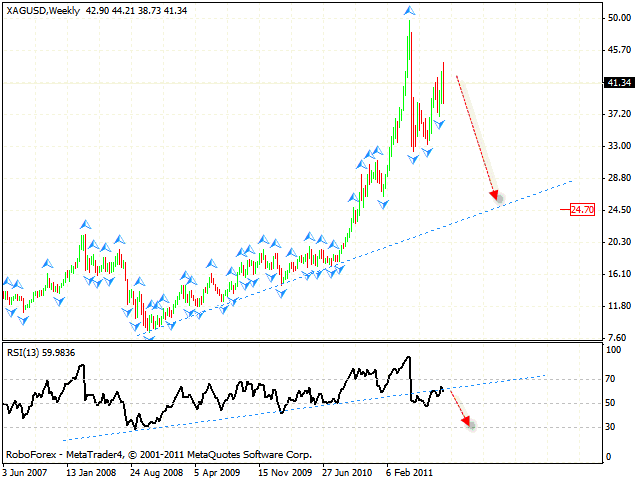

SILVER

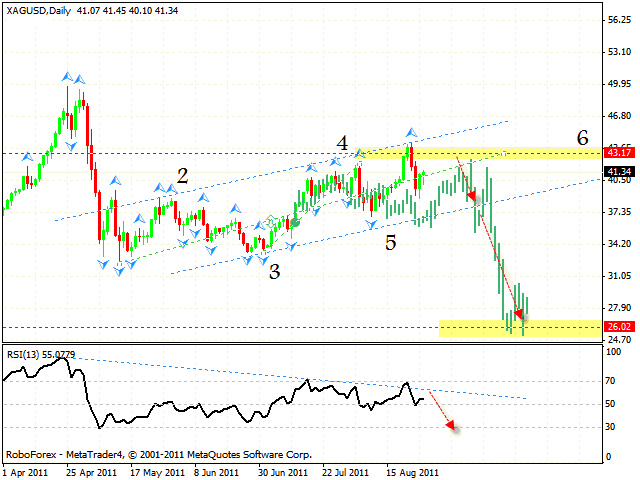

Judging by the weekly chart of Silver, we may suppose that the price is going to fall into the area of 24.70. The rising trend’s line at the RSI has been broken, and now the price is moving back towards the broken line. We should expect the price to rebound from it and start moving downwards. But if the indicator grows into the area of 70. This case scenario will be cancelled.

At the daily chart of the instrument, the target of the rising pattern in the area of 43.17 has been reached. One can either try to sell Silver when reversal patterns appear at shorter periods of time, or wait until the price breaks the channel’s lower border and start selling the instrument with the tight stop after that. The target of the fall is the area of 26.00.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.