Technical Analysis & Forecast 12.04.2024

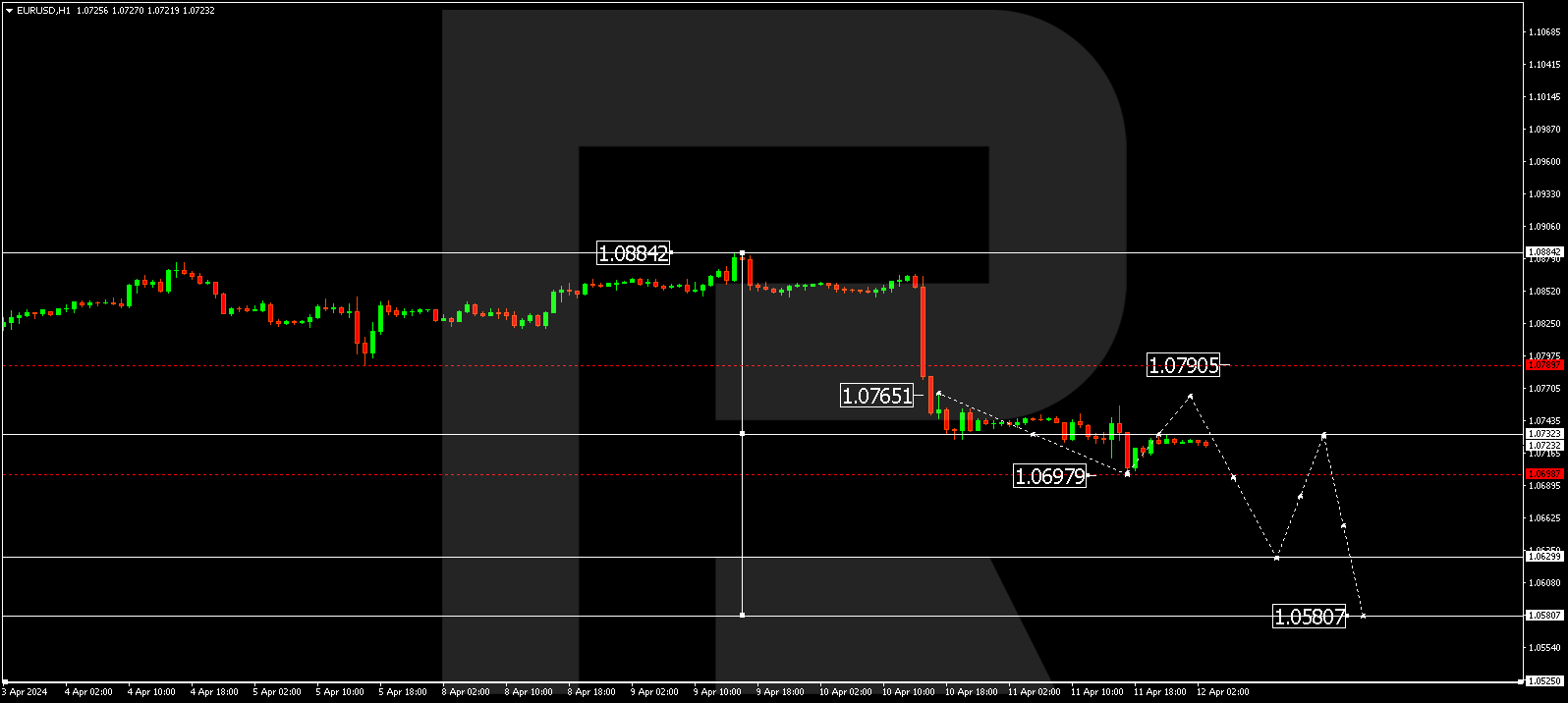

EURUSD, “Euro vs US Dollar”

The EURUSD pair continues developing a consolidation range. By now, a decline wave structure has been completed at 1.0700 alongside a correction towards 1.0733 (testing from below). Practically, a trend continuation pattern has formed around 1.0733. With an upward escape from the range, a correction link towards 1.0765 is not excluded. With a downward escape, the potential for a wave towards 1.0630 could open, from which level the trend might extend to 1.0580. This is a local target.

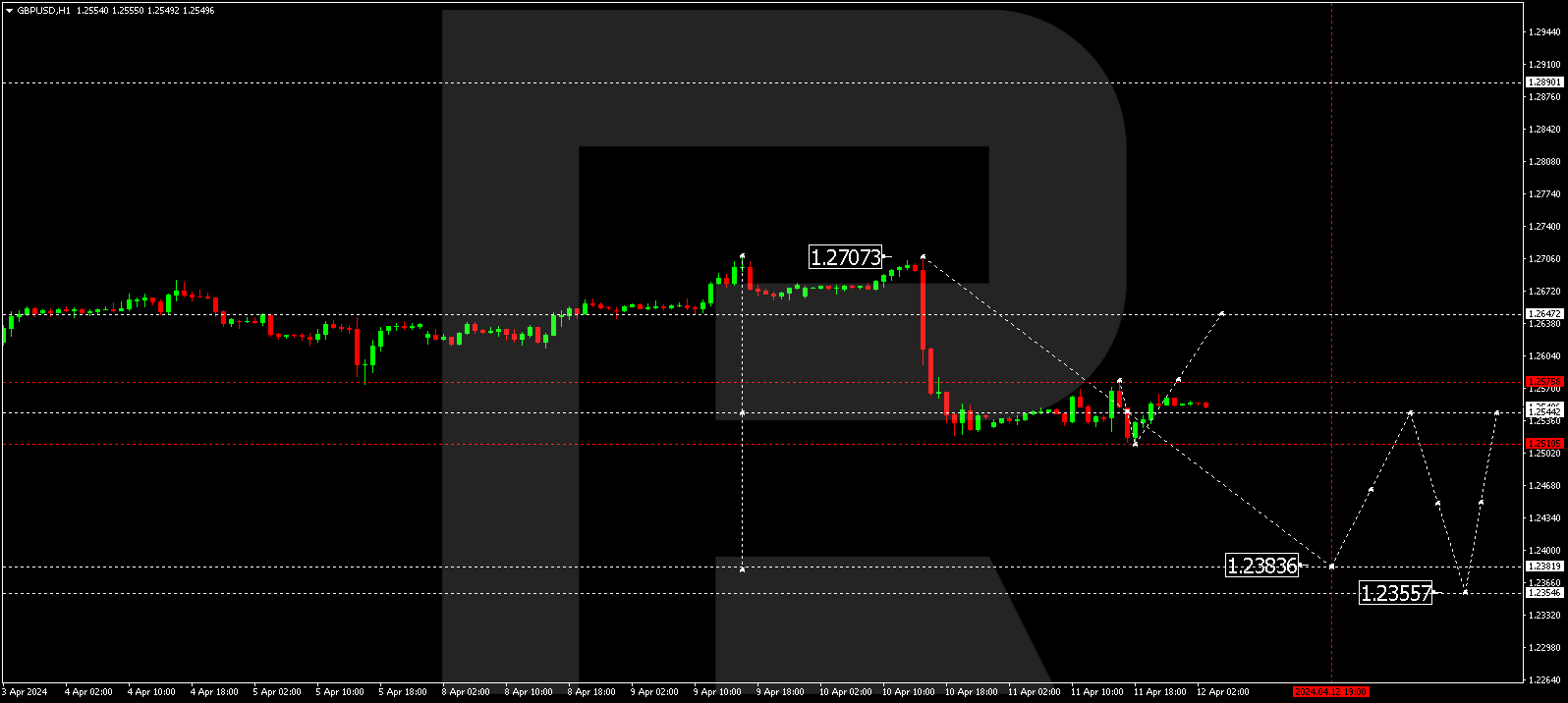

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair formed a decline wave to 1.2510 and corrected towards 1.2563 today. Practically, a consolidation range has formed, which can be interpreted as a trend continuation pattern. With an upward escape from the range, the correction could extend towards 1.2646. With a downward escape, the potential for a wave towards 1.2440 might open, from which level the trend could continue to 1.2384. This is a local target.

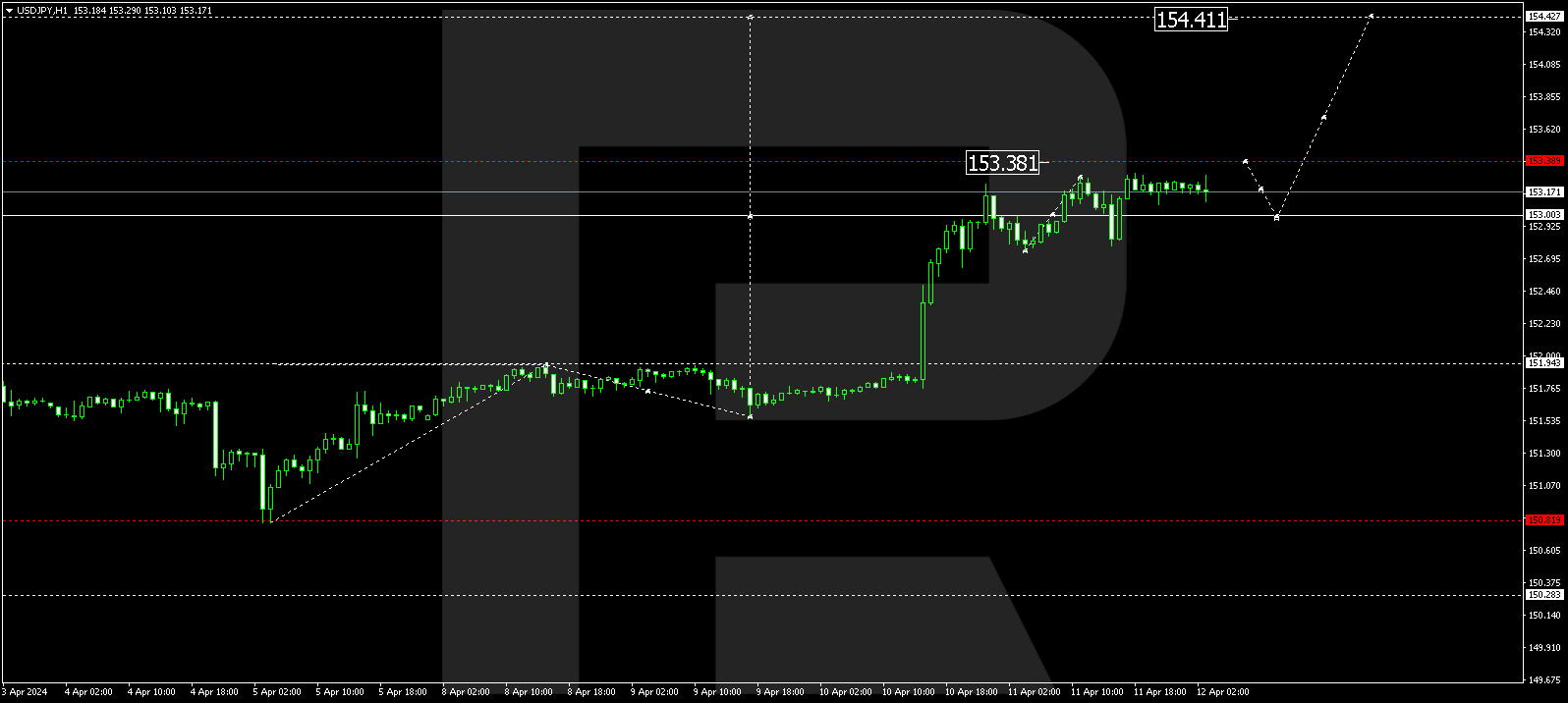

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair continues developing a narrow consolidation range around 153.00. The range might expand to 153.38 today and then drop to 153.00. With an escape from this range downwards, a correction link to 152.00 is not excluded. With an upward escape, the potential for a wave by the trend towards 154.40 might open. This is a local target.

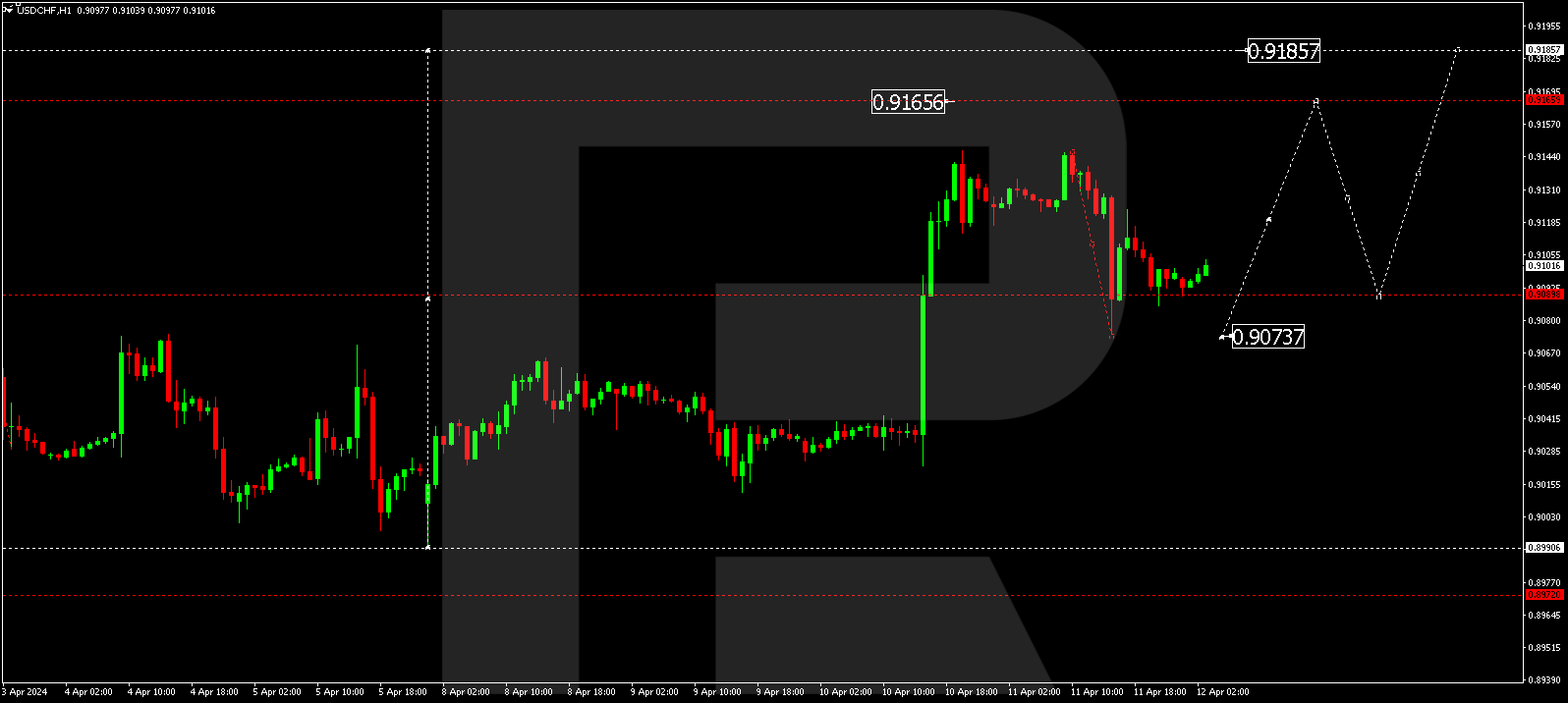

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair is forming a consolidation range above 0.9090. A decline link to 0.9074 is not excluded today. Next, a new growth wave to 0.9166 is expected, which is a local target.

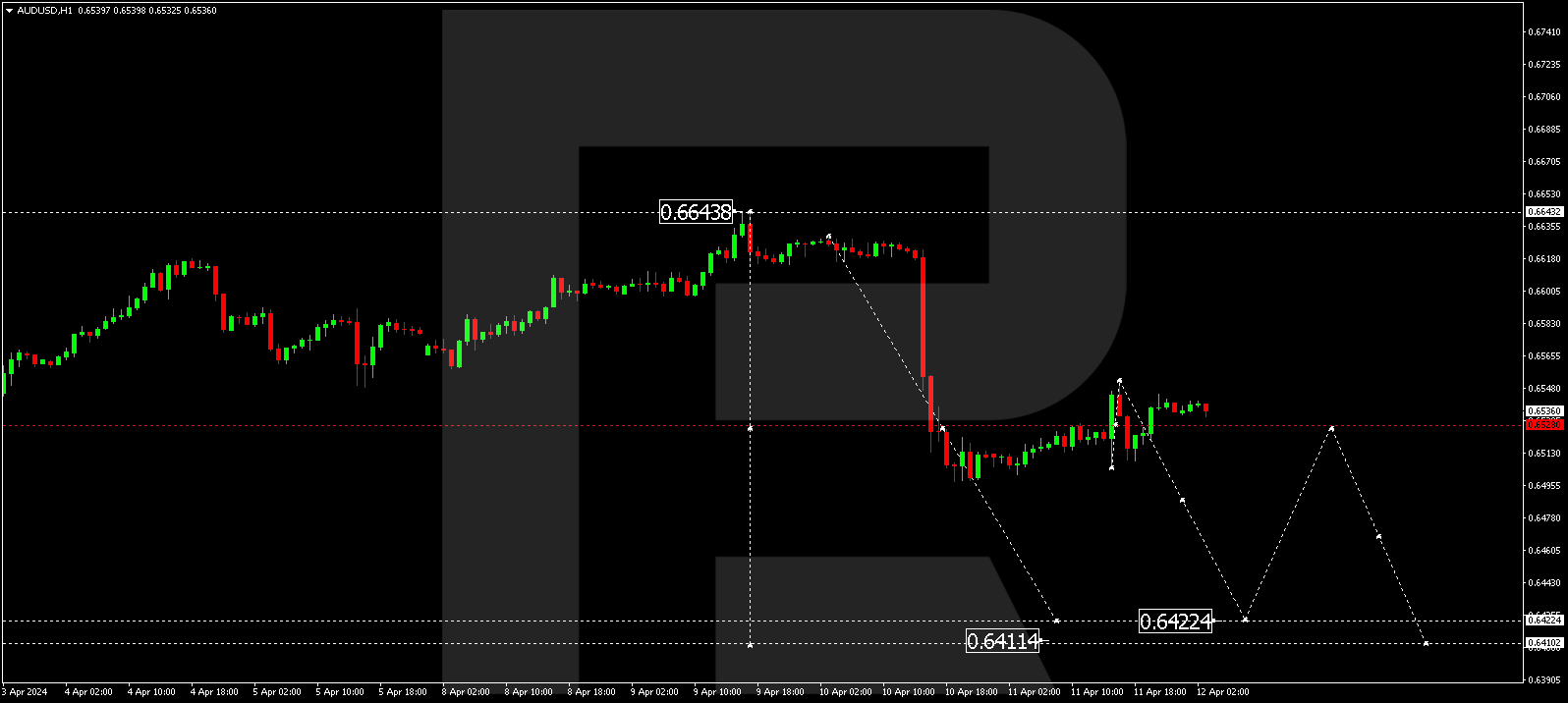

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair continues developing a consolidation range around 0.6528. With an upward escape from the range, a correction link to 0.6565 is not excluded. With a downward escape, the trend could continue to 0.6422. This is a local target.

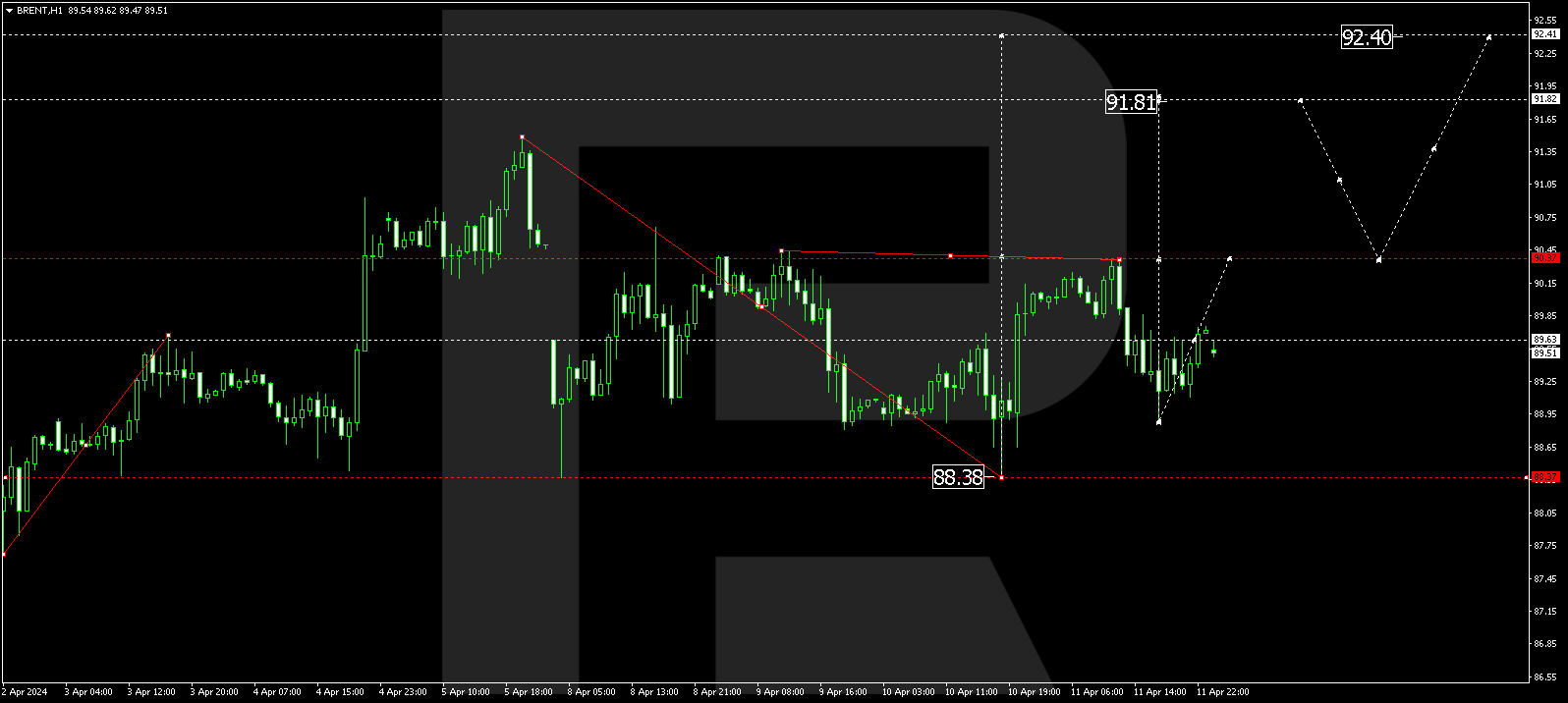

BRENT

Brent has finished correcting at 88.88 and is forming a growth wave structure towards 90.37 today. Be this level also breached upwards, the potential for a wave towards 91.81 could open. This is a local target. Next, the quotes could correct to 90.40 (testing from above) and rise to 92.40, from where the trend might extend to 97.00. This is the first target.

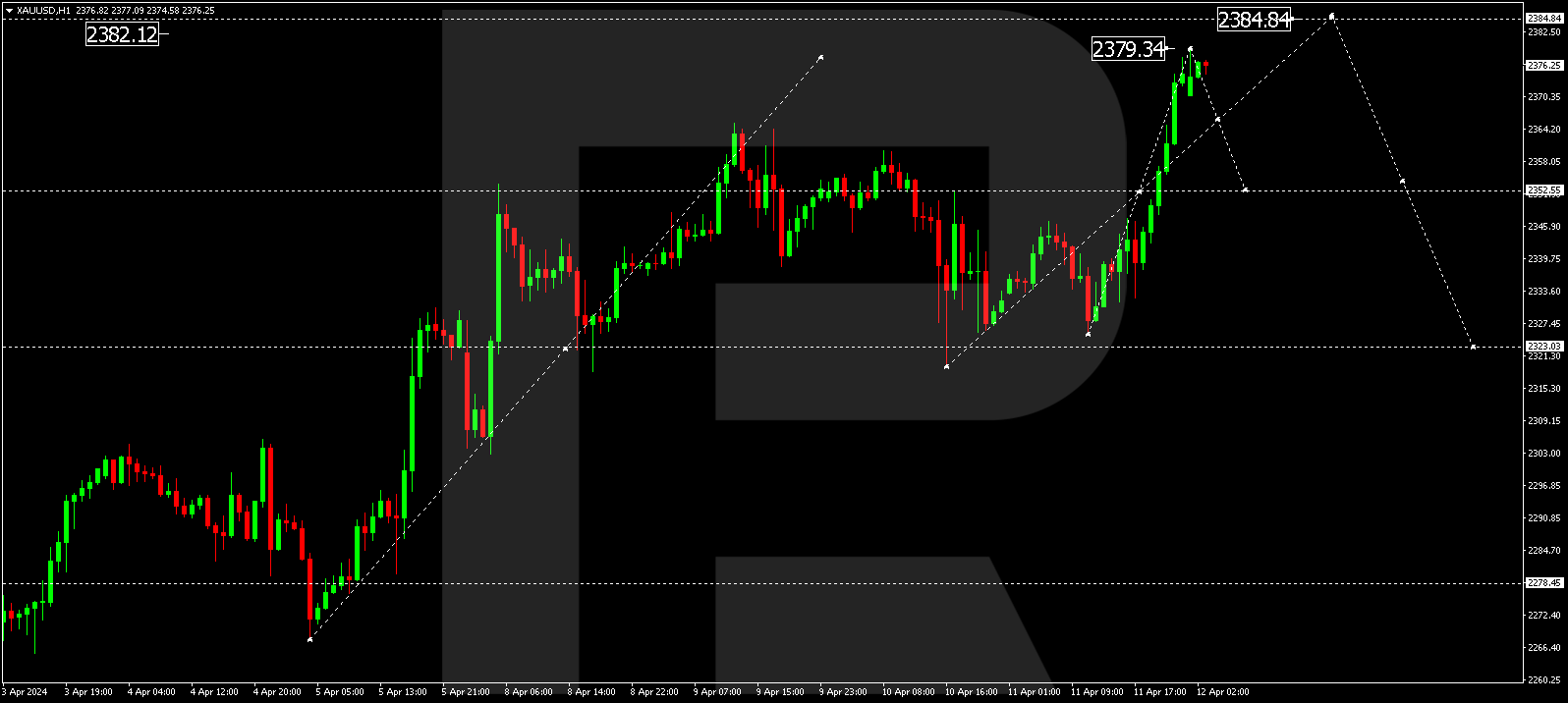

XAUUSD, “Gold vs US Dollar”

Gold has broken the 2352.55 level and continues developing a growth wave. By now, a range extension link towards 2379.33 has formed. The trend could continue to 2384.84 today. Once this level is reached, a consolidation range is expected to form. With a downward escape from the range, a correction to 2323.23 could begin. With an upward escape, the wave might continue towards 2430.00. This is a local target.

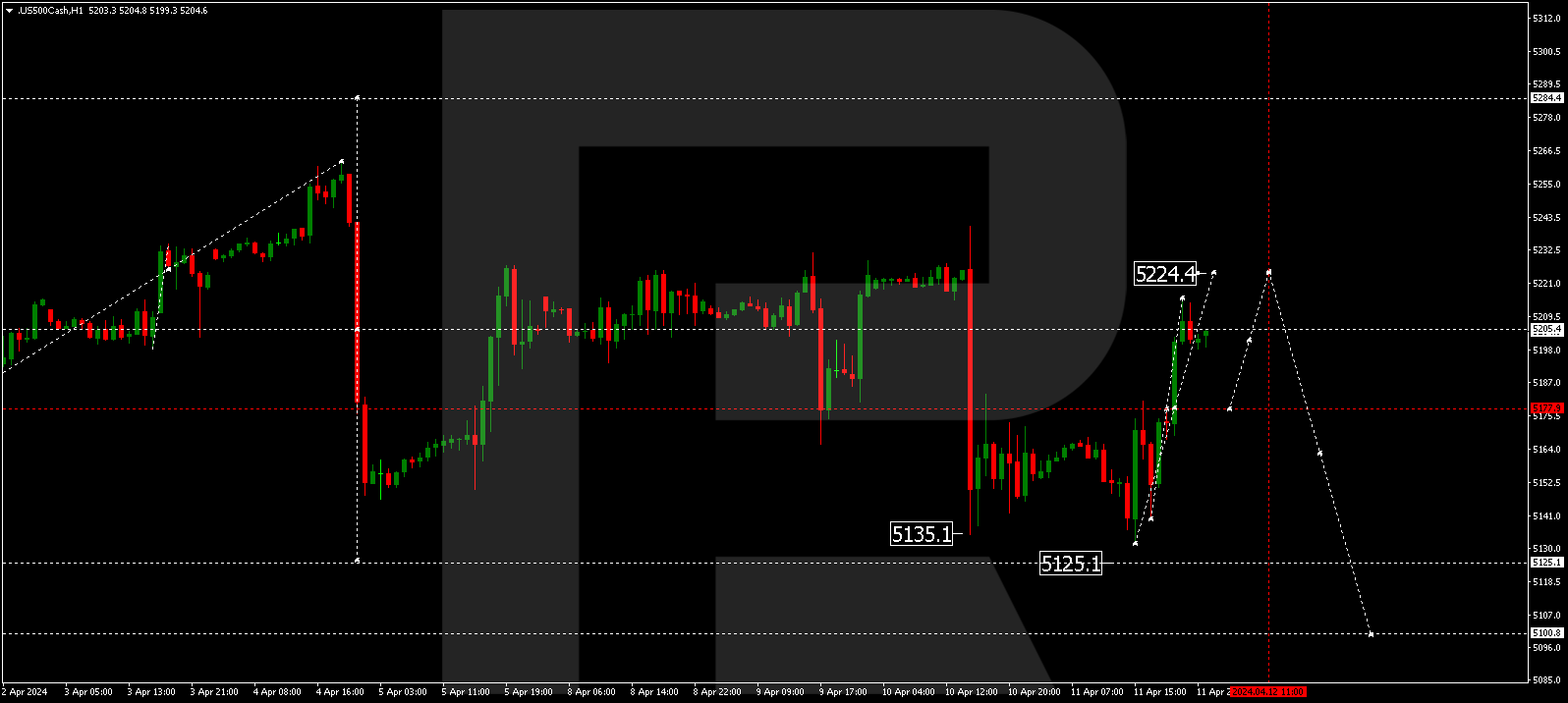

S&P 500

The stock index has formed a decline wave to 5131.0. A correction link to 5205.0 has formed today. A consolidation range is expected to form under this level. With a downward escape from the range, the potential for a decline wave to 5100.00 might open. This is the first target. Once this level is reached, a correction to 5225.0 could start.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.