Forex Technical Analysis & Forecast 28.11.2022

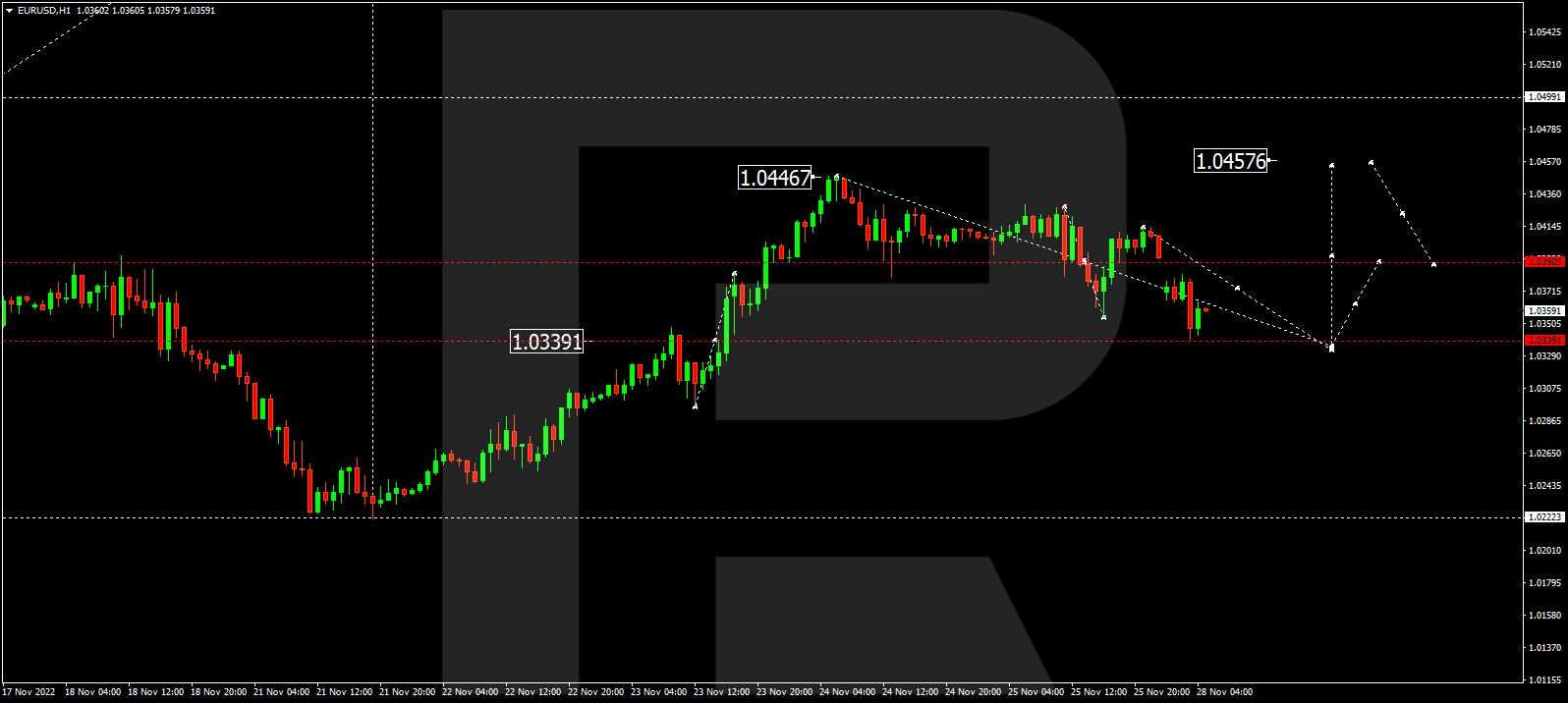

EURUSD, “Euro vs US Dollar”

The pair has formed an impulse of decline to 1.0354 and a correction to 1.0413. Today the market is forming the second declining impulse. At the moment, a structure of decline to 1.0345 was completed. A consolidation range is expected to form around this level. With an escape downwards, the wave of decline should continue to 1.0282. The goal is local.

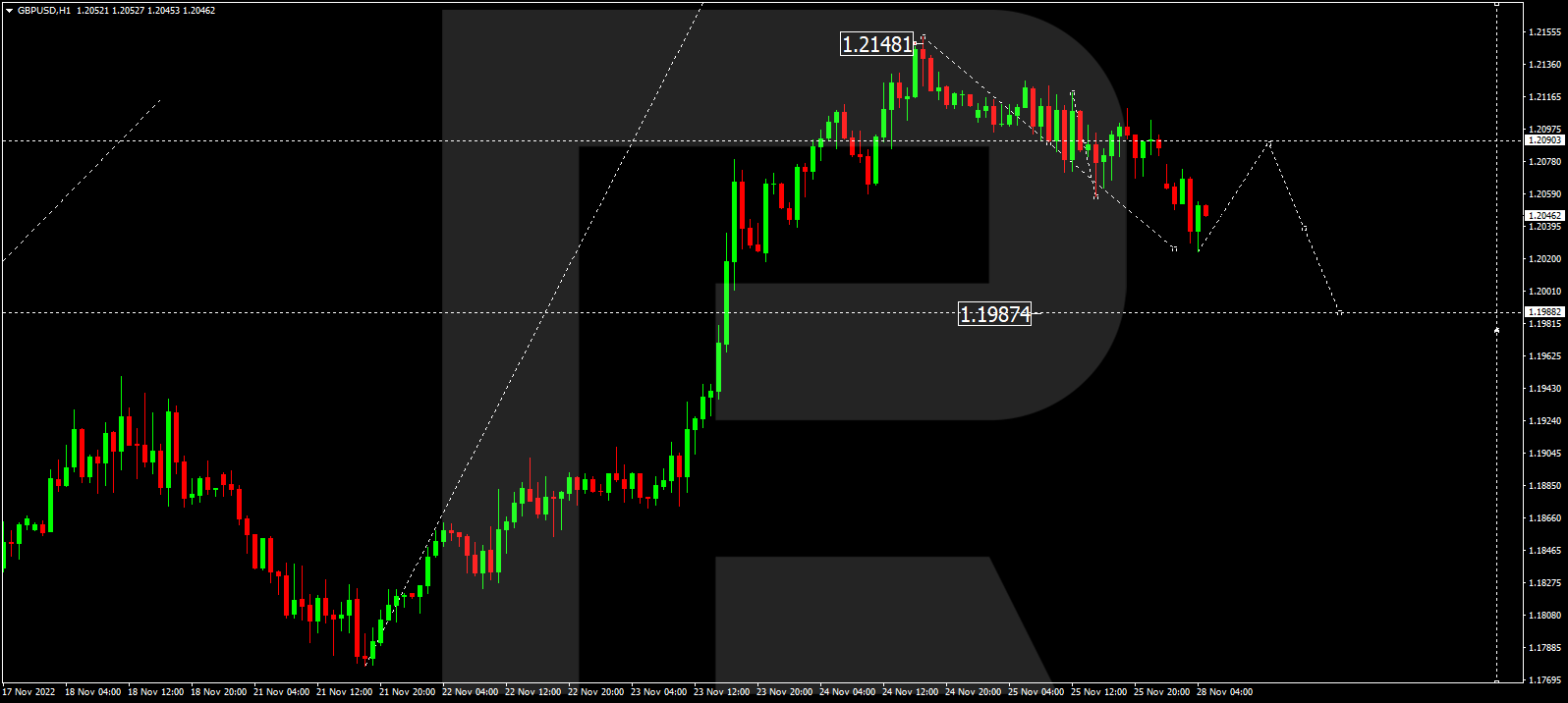

GBPUSD, “Great Britain Pound vs US Dollar”

The currency pair has formed an impulse of decline to 1.2057 and a correction to 1.2109. Today the market is forming the second impulse of decline. At the moment, a structure of decline to 1.2030. A consolidation range is expected to form around this level. With an escape downwards, a pathway down to 1.1988 will open. The local is local.

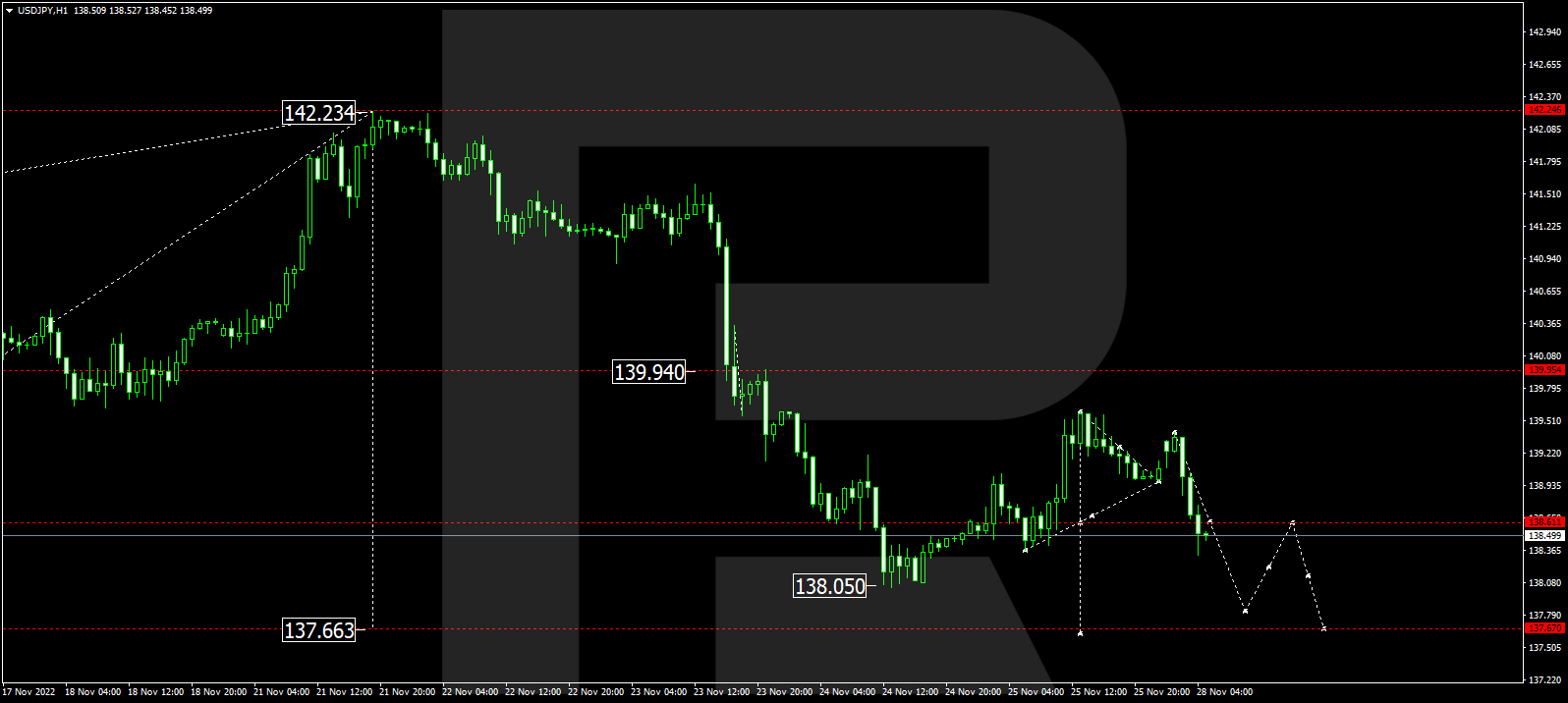

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has formed an impulse of decline to 138.98 and a correction to 139.40. Today a second impulse of decline is forming to 137.84. After this level is reached, a link of growth to 138.62 is not excluded, followed by a decline to 137.67.

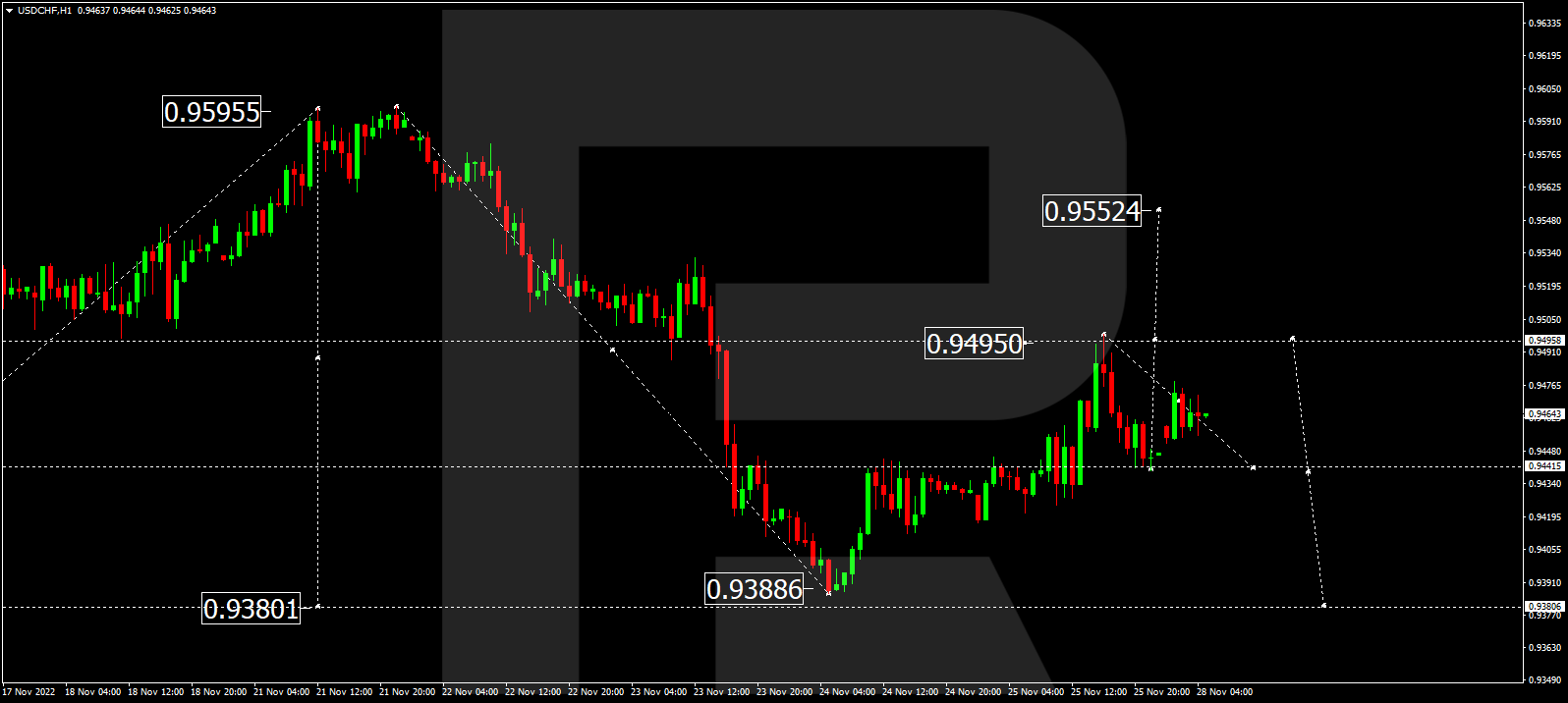

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has completed a link of correctional decline to 0.9444. Today an impulse of growth is forming to 0.9494. This level is likely to be broken away upwards as well. The goal of the growth is 0.9555.

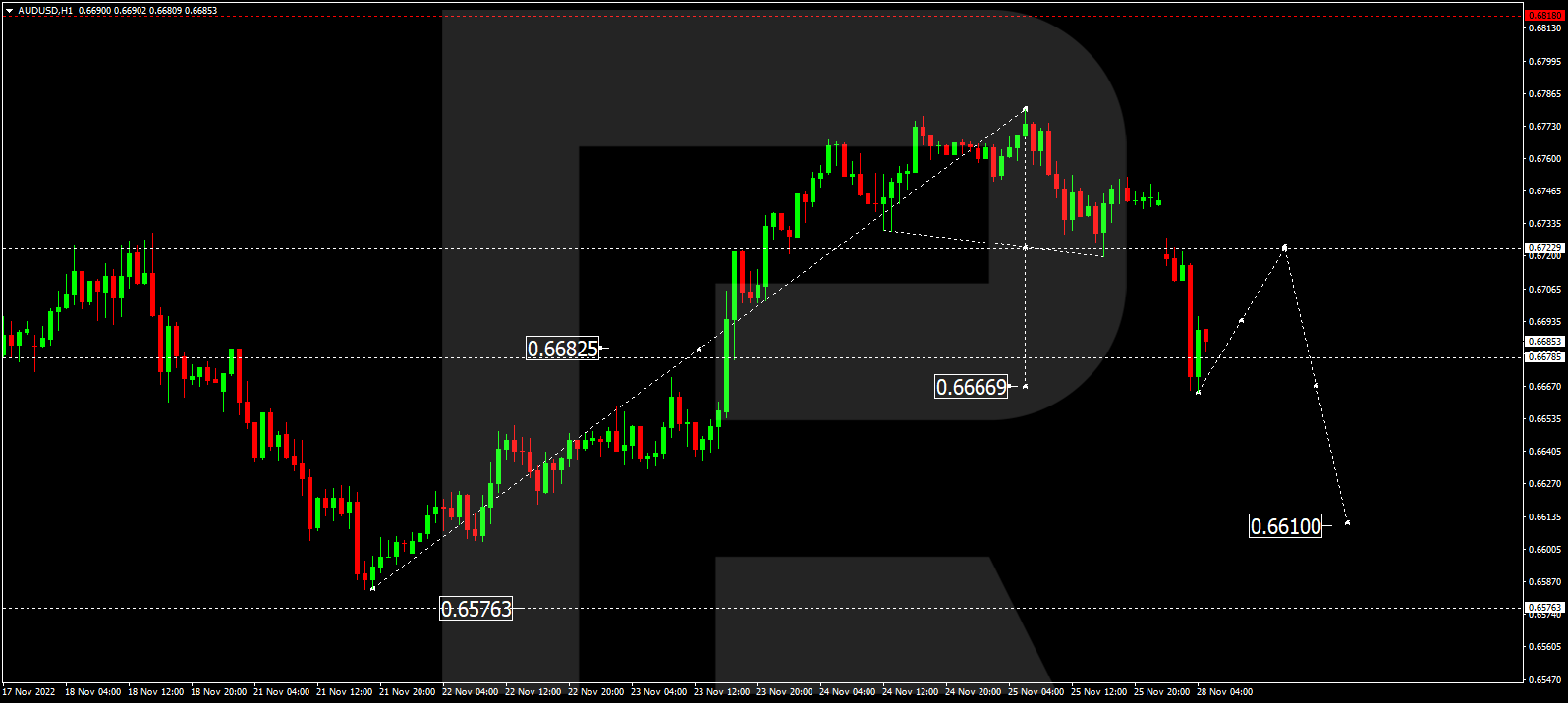

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has formed an impulse of decline to 0.6720 and a correction to 0.6752. Today a second impulse of decline has formed to 0.6666. A link of correction to 0.6710 is not excluded, followed by a decline to 0.6642.

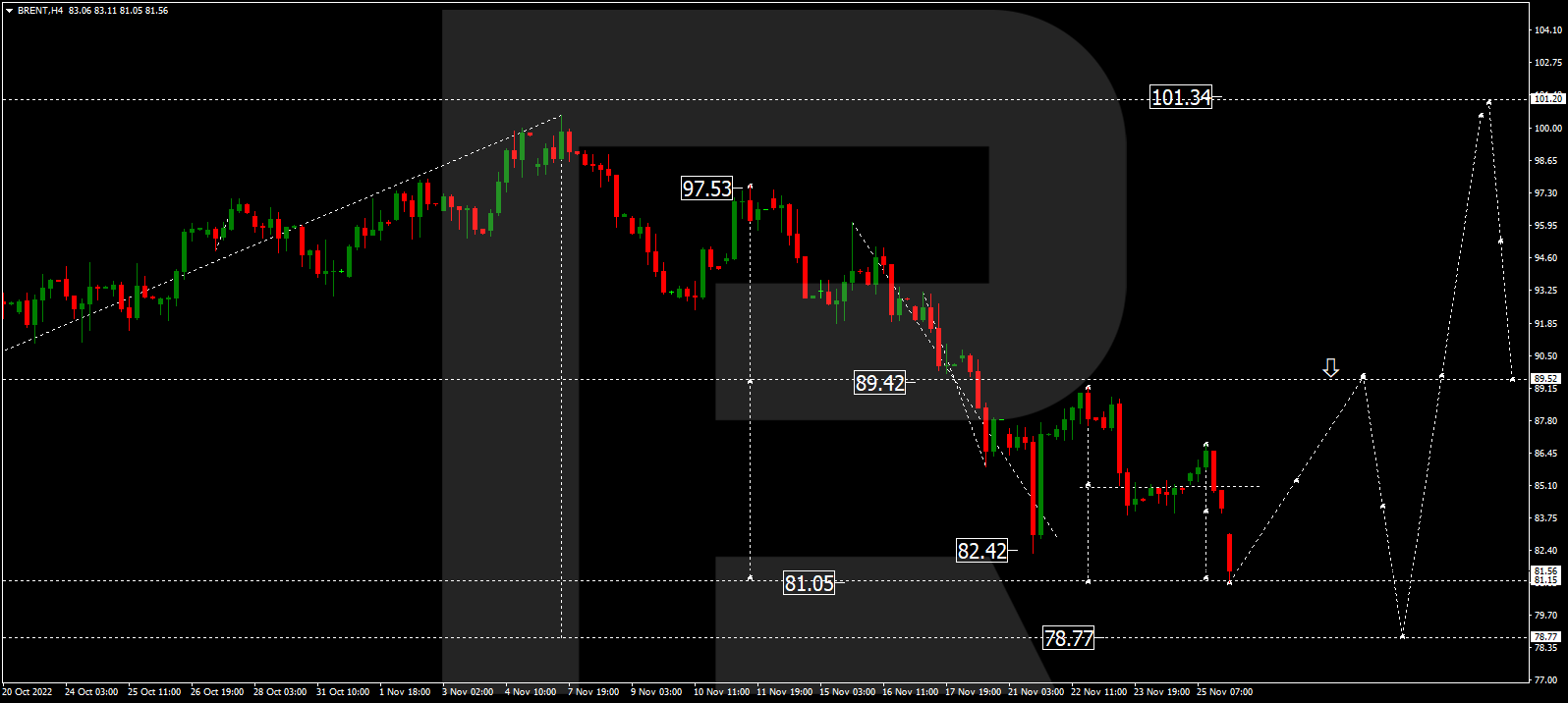

BRENT

Crude oil has formed a consolidation range around 85.00. At the moment, the market has extended the range up to 86.84. Today the lower border of the range has been broken away and a structure of decline to 81.05 has been formed. A link of correction to 89.50 is not excluded. Then another structure of decline to 78.78 is likely to develop.

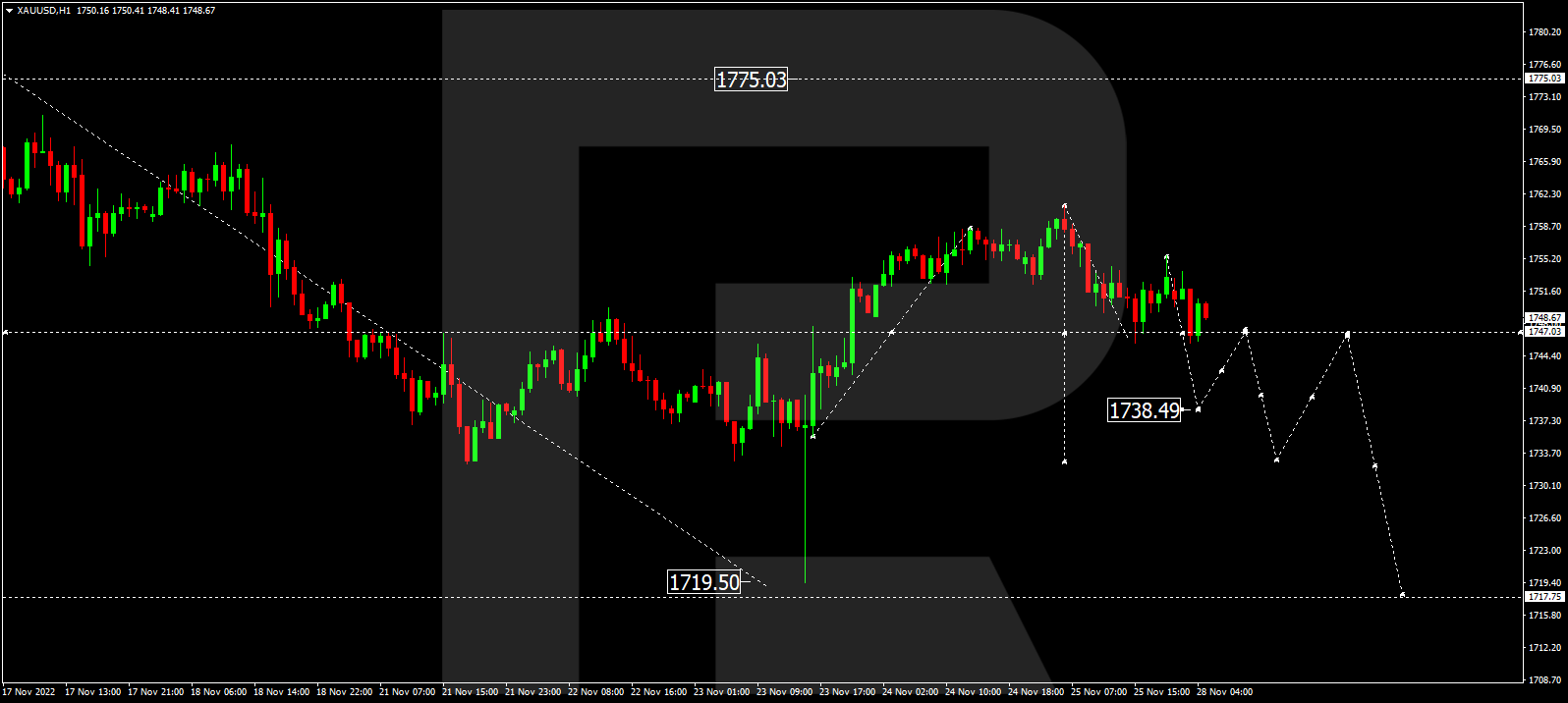

XAUUSD, “Gold vs US Dollar”

Gold has formed an impulse of decline to 1745.87 and a correction to 1755.47. With an escape downwards a pathway to 1738.49 will open, from where the wave might continue to 1733.70. With an escape upwards, a link of growth to 1762.00 is not excluded.

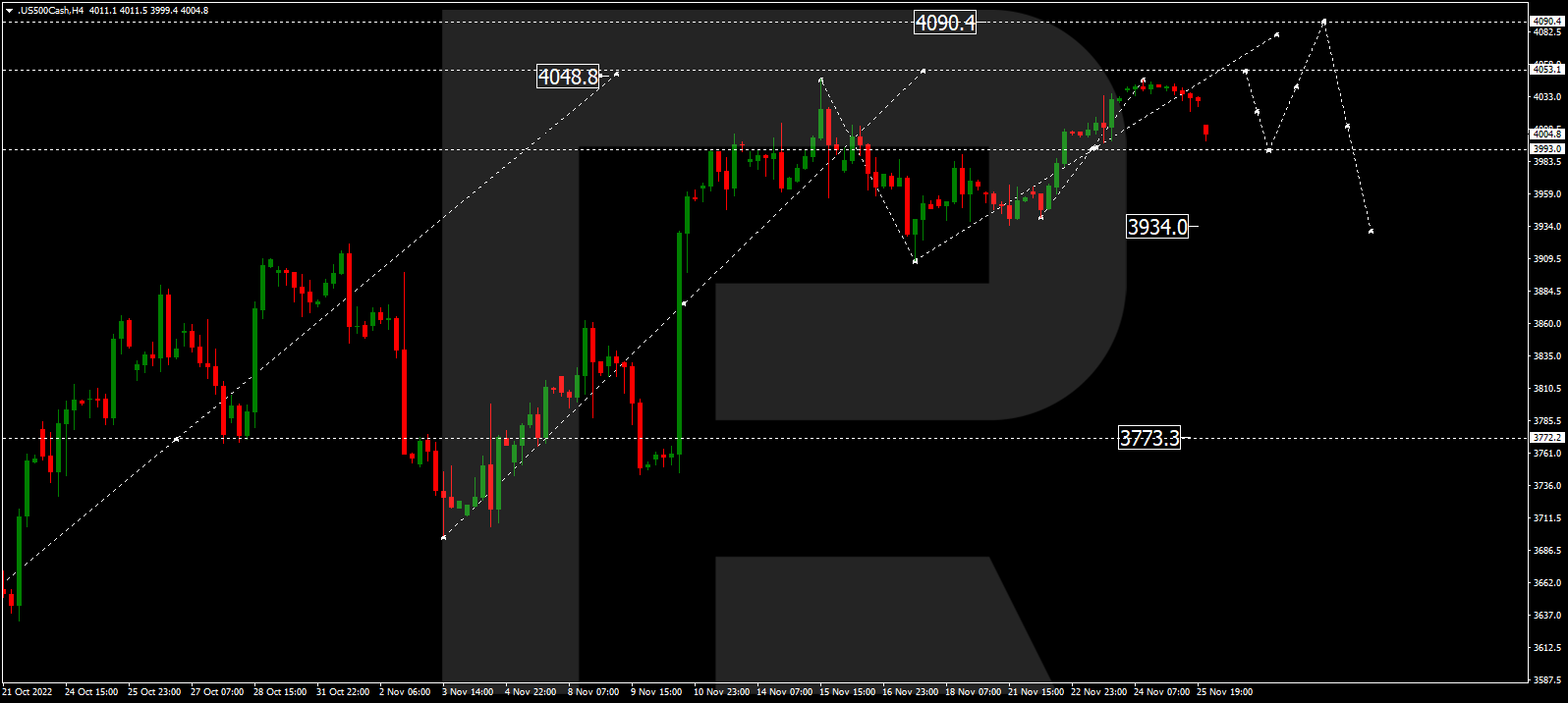

S&P 500

The stock index has formed an impulse of growth to 4046.0. Today a structure of decline is forming to 3990.0. Then a link of growth to 4070.0 is expected, after which a wave of decline to 3934.0 should start, from where the trend may continue to 3777.7.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.